Dear Partners and Friends,

Please find below our third whitepaper, covering the persistence of LP-stakes, the historical pillar of secondary transactions.

1. Traditional secondary transactions

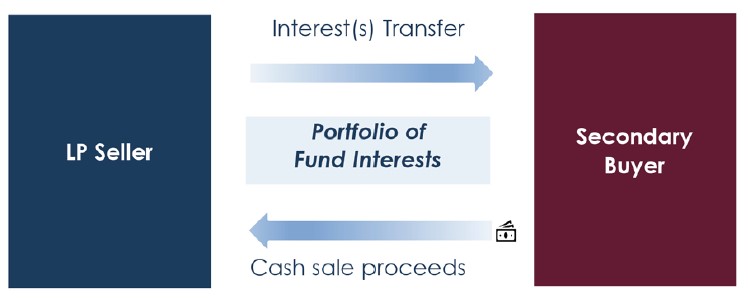

LP-stakes portfolio sales are transactions involving the transfer of ownership of LP interests in one or more Private Equity, Infrastructure or Private Debt funds. The buyer will acquire the selling LP’s interest in the fund and take on the selling LP’s commitments to meet future capital calls.

Traditionally, secondaries were very focused on LP interests, as opposed to GP-led transactions. If an LP wanted to step out of a Private Equity fund early, the only way they could achieve liquidity was through a secondary transaction. The secondary market has existed since the 1980s when it was still a tiny segment of Private Equity, and it has evolved into a $100bn market in 2021. Today, secondary transactions are increasingly contemplated and completed by specialized secondary investors.

The seller of secondary assets can be any Private Markets investor. On a large scale, the sellers are typically public pension plans, sovereign wealth funds, financial institutions, insurance companies, funds of funds or asset managers, because they invest substantially in the Private Equity market. On a smaller scale, there are also family offices, foundations, or corporate pensions.

LPs are spending more time underwriting and re-evaluating their existing portfolios by selling their funds stakes before they reach the “tail-end stage” which is defined as the end of the original term of the fund. This results in more recent vintage assets for sale and an overall increase in turnover.

2. The LP-stakes sale process

In a secondary portfolio sale, as a result of a competitive bidding process, a selected secondary buyer purchases the seller’s fund interests. At closing, the investor pays the purchase price and the ownership of the funds’ stakes is directly transferred to them. The secondary investor is held responsible to pay all future capital calls made by the fund and will receive all future distributions from the fund.

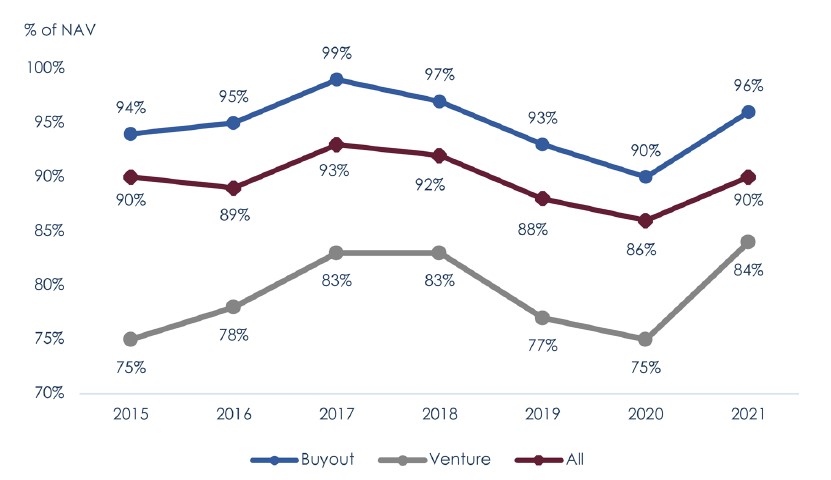

In a typical secondary transaction, the pricing of the individual fund interests is based on the reported Net Asset Value of each fund, at a given reference date. After thorough analysis of the portfolio based on the underlying funds’ reports and the seller’s capital accounts, the secondary investor offers a purchase price as a percentage of the NAV at the reference date.

This price is then adjusted for subsequent cash flows: the postreference date capital calls will increase, while distributions will decrease the final purchase price.

3. The growth of the LP-stakes secondary market

Until 2020, LPs selling portfolios of fund interests represented the majority of secondary market transaction volume. Demand for secondaries has increased drastically in the last decade as the market has matured, attracting an increasing number of buyers and investors to the asset class.

According to Secondaries Investor, the traditional LP portfolio volume was positioned for a stout comeback after a brutal drop of the transactions volume due to the Covid crisis and grew by 58% from H1 2020 to reach $19 billion in H1 2021. Growth in concentrated LPstakes transactions left buyers wanting diversification, paving the way for a favorable LP selling environment. Ten LP portfolio sales greater than $500 million closed in H1 2021, of which five represented deals greater than $1 billion.

The interest of secondary investors for LP-stakes is on the rise with several large LPs looking to hit the market with sizeable portfolios. In 2020, BPI France managed the sale of fund stakes in which the portfolio was split between two buyers. Once the price of the transaction was established by these institutional acquirers, a slice of the transaction representing €95m was offered to retail investors at the same pricing conditions. Another similar transaction is currently in progress.

Overall, the huge growth of the secondary market has been supported by the development and expansion of the market’s intermediary channel, including the availability of secondary advisory firms to support and coordinate transactions. Jasmin Capital has accompanied many private markets LPs over the last years for the sale of their funds’ stakes, including insurance companies, fund of funds, banks and private banks, family offices, pension funds etc.

4. Reasons to launch LP-stakes

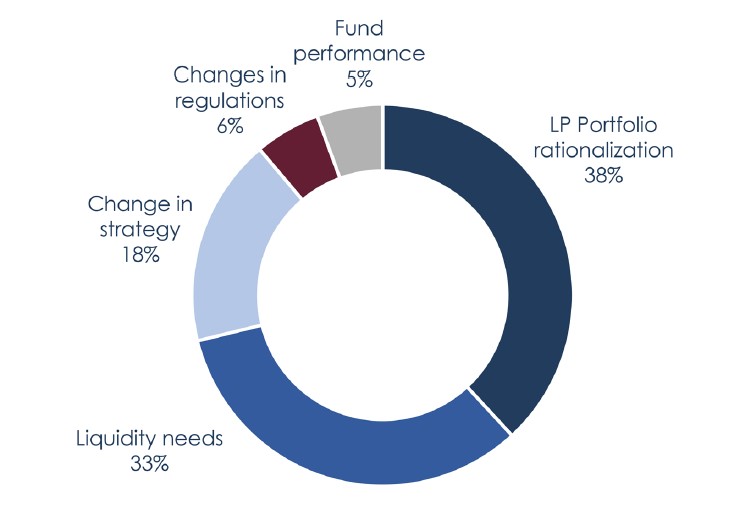

Sellers are motivated to sell a part of their Private Equity positions, for reasons that mainly include liquidity needs. With the life span of Private Equity funds often exceeding the original 10 years term, the secondary market offers an appealing liquidity option in an illiquid asset class. Selling tail end portfolios (portfolios which have delivered the majority of their performance and with a limited remaining uplift) is a growingly sought-after solution for LPs looking to actively manage their assets. Furthermore, for an LP that decides to no longer be invested in a specific manager’s fund or to reduce the number of its GP relationships, the secondary market is a great opportunity to rationalize GP relationships by selling stakes

in selected funds. A secondary sale can also be a useful tool for LPs, looking to reduce their Private Equity exposure either due to a change in their investment strategy, to regulatory requirements or alternatively to a merger between institutions. An LP-stakes sale adds flexibility in managing a portfolio of Private Equity investments, allowing LPs the option to sell their stakes at their convenience.

From the secondary buyer’s perspective, they can access investments at various stages of maturity and obtain additional means of exposure to specific managers and strategies. Plus, the secondary investors can benefit from a “selection bias” in knowing how the fund performed thus far. Secondary investors remain eager for high-quality, diversified LP portfolios, and expect to generate attractive IRR from the transaction.

5. Pricing of secondary transactions

LP portfolio opportunities led to greater selectivity among some buyers, there was an overall increase in the bidding activity in 2021, after the Covid crisis.

LP portfolios received featured bids from 40% of contacted parties. This activity led to better pricing discovery and more optionality for sellers, which ultimately resulted in a higher proportion of closed deals. Besides, it is also essential to note that pricing levels can vary greatly, depending on fund age, perceived GP quality, fund strategy, and size of the fund interest for sale. A 4 or 5 years old midcap LBO fund is currently priced at NAV or even at a premium depending on its remaining assets, versus a VC fund which is priced at a 10 – 20% discount. A deferred payment schedule is also a rather common tool that can be put in place with a secondary advisor’s help to enhance the price for the seller.

During the Covid crisis, there was a drop in LP-stakes transaction volumes due to the important bid-ask pricing spread between buyers and sellers. Since the beginning of 2021, this mismatch started to reduce sharply, the volume decline didn’t last long.

6. Emphasis points of an LP-stakes sale

Secondary transactions are becoming very popular in the Private Equity asset class even though the terms used in the Purchase and Sale Agreements (PSA) can be complex to understand. When reviewing the governing documents of the fund, the key provisions to focus on are detailed in the transfer section of the Limited Partnership Agreement (LPA), as this section explains the process required to transfer the fund interest to a new investor.

In substantially all Private Equity funds, the transfer of an LP interest to a new investor requires the consent of the fund’s GP, so the terms of these Purchase and Sale Agreements (PSA) are made contingent upon securing GP consent. In some cases, a fund agreement may provide for a right of first offer in favor of the fund’s existing LPs in which case conflicts may potentially arise. Most fund partnership agreements require the GP to confirm that the proposed transfer will not cause any legal, tax, or regulatory issues for the fund.

In addition, sellers and buyers should be aware that a sale price that is considerably lower compared to the fund’s reported NAV could create obstacles for GP consent because the proposed sale could raise questions about the fund’s appraisal process, the GP’s veracity, and the values reported by other investors to their boards.

With the secondaries market growth, Publicly Traded Partnership (PTP) clauses have become increasingly important because they can cause a buyer and a seller to pause a deal and delay its outcome. Fundamentally, a PTP is a US tax-related issue that can entail funds structured as a partnership to be treated as corporations and thereby be liable for tax. A partnership is defined as a PTP if its interests are readily transferable on a secondary market, or if its interests are traded on an established securities market. The two exceptions to the rule which allow achieving PTP safe harbors are: (i) The fund must have no more than 100 partners during its taxable year; (ii) The sum of all the fund’s interests transferred in one calendar year does not exceed 2% of the total NAV. As a consequence, if a large number of transfers occurs simultaneously, a GP may delay the transaction to the following year in order to remain within the 2% of the outstanding interests.

A further challenge implied by LP-stakes secondary transactions regards the new rules about ECI (Effectively Connected Income) which relates to the non-US sellers of stakes in limited partnerships who are exposed to a US business. When buying a stake in a fund, an investor must seek insurance from the seller or the GP in the form of a certificate stating that there are no assets in/exposed to the US. Failure to obtain this certificate may result in a 10% withholding tax imposed on the gross amount realized on a sale of a fund’s interest if any portion of the sale gain would be treated as ECI.

LP-stakes transactions require these technical challenges to be dealt with, which is why LPs systematically work with secondary advisors that bring transaction execution and market-practice experience to the table. After the punctual changes in circumstance brought on by collateral Covid effects in the LP-stakes market, the vertiginous rebound in offer and demand has grounded claims that LP-stakes remain a backbone in the secondary market and will continue to grow as a relevant portfolio optimization tool and liquidity solution for LPs.

Jasmin Capital has a recognized LP-stakes track record, acting as a sell-side advisor to LPs allowing them to achieve maximized pricing, a processed execution, and an efficient closing.